While almost everyone (and their dog) now knows about bitcoin, it is still very difficult for the average person to actually buy it. Purchasing bitcoin and other types of cryptocurrency requires a level of techy knowledge that can be a barrier. This includes digital wallets, currency conversion, complicated passwords and so on.

Cryptocurrency can also be a risky investment, with prices fluctuating wildly from one day to the next. So while everyone might be aware and curious about cryptocurrency, benefiting from it is still out of reach for most people.

Bamboo

Enter Bamboo, a West Australian startup whose mission is to make a cryptocurrency investment platform for the rest of us.

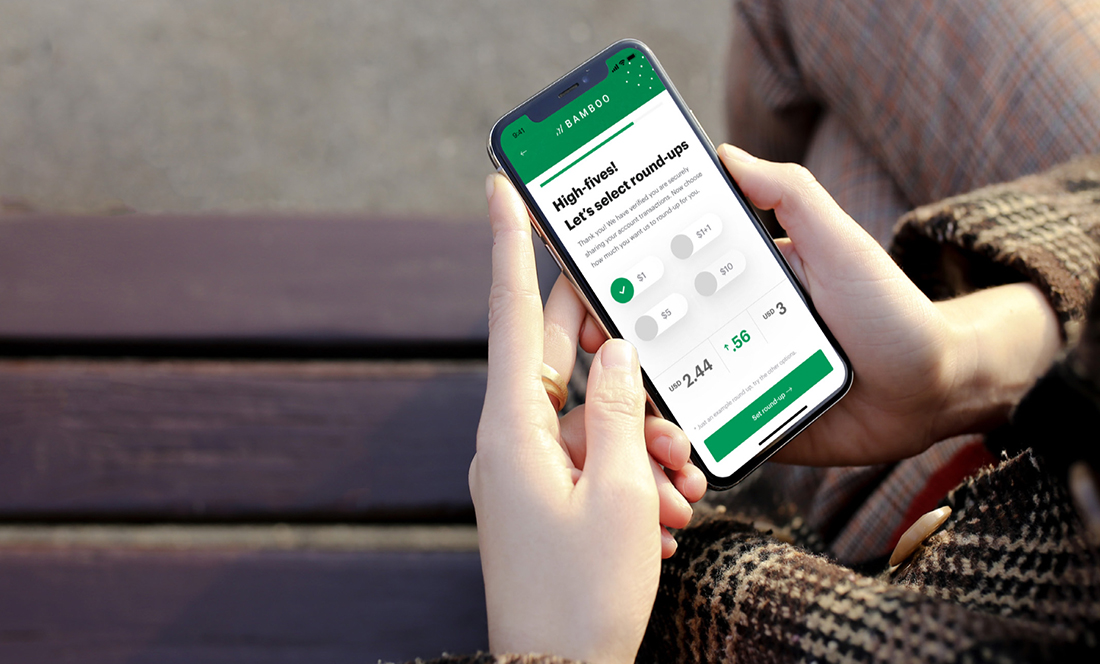

Bamboo brings together two new ideas. One complicated (cryptocurrency) and one a bit more simple (microinvesting). As platform Raiz (previously Acorns Australia) describes on their site, microinvesting works by transferring “spare change automatically from everyday purchases into a diversified portfolio”. For example, if you were to buy a coffee for $4.80, Raiz would round the sale up to $5.00 and then invest the $0.20 for you.

In this way, microinvesting makes investments super easy and accessible to everyone. This is why microinvesting is particularly popular with Millennials. Millennials are less likely to have the knowledge, interest or resources to make more traditional investments (insert joke about smashed avo toast here).

1 + 1 = 5

Now here’s where Bamboo is different. Existing microinvestment platforms invest your money in the usual old-school way—stocks, bonds and so on. Bamboo, on the other hand, will invest it in a variety of cryptocurrencies. And they make the process quick and easy in a way that doesn’t require lots of technical knowledge and time. As Nesh Sooriyan, COO and co-founder of Bamboo told me, you can invest in crypto via Bamboo with as little as $1 and in less than a minute.

Going global but staying local

Founded by West Australians and with a research and development arm based in the state, Bamboo is moving globally. While the company is located in Switzerland, they’ve maintained WA as their home base. As Nesh shared with me, “We stayed in WA because the Spacecubed [startup] community was so strong.” Bamboo was also impressed by the level of local cryptocurrency talent, which enabled them to also hire their team here. Nesh shared with me that Australia has some of the best R&D talent they’ve come across in the space.

“We stayed in WA because the Spacecubed [startup] community was so strong.”

Bamboo is yet another example of West Australian ingenuity in the blockchain and fintech space. They join the ranks of other ground-breaking WA startups. This includes Power Ledger, who are using blockchain to enable clean power sharing, DigitalX Investments, a crypto investment fund, and Credi, which provides peer-to-peer lending.